What’s the Future of Disney Stock and Should You Buy Now?

You may have spent $1,000 on Disney ears, $300 on Disney bags, and hundreds on tickets and hotels in Disney — so why not take your cash to the next level and actually invest in Disney, like for REAL?  Might as well get something out of all that money you spend at the “Most Magical Place on Earth,” right?!

Might as well get something out of all that money you spend at the “Most Magical Place on Earth,” right?!

Well, one way to invest in Disney “for real” is to buy Disney stock. Over the past several years, we’ve seen Disney stock go for a pretty intense roller coaster ride — one even Expedition Everest would be jealous of. So what’s going on with the stock right now? Where could it be headed in the future? And is NOW the time to invest? Here’s what we’re seeing.

Disclaimer: We are Disney Food Blog (you know that because you came here, but we’re reiterating it just in case  ). We are not an investment agency or financial advisor. What we’re about to share is an analysis of the recent history of Disney’s stock, how events in the future could impact it, and what analysts are saying about whether or not to buy the stock right now. This is not formal financial advice. Ultimately, any financial decisions you may or may not take regarding Disney stock and investments should be made upon your own determinations and advice from true financial advisors.

). We are not an investment agency or financial advisor. What we’re about to share is an analysis of the recent history of Disney’s stock, how events in the future could impact it, and what analysts are saying about whether or not to buy the stock right now. This is not formal financial advice. Ultimately, any financial decisions you may or may not take regarding Disney stock and investments should be made upon your own determinations and advice from true financial advisors.

Also, keep in mind that this is just a snapshot of what’s happening with Disney’s stock right now and what could happen in the future. Things could change dramatically in the next several days, weeks, and months. We’ll be on the lookout for big updates though, so be sure to stay tuned!

Alright, let’s get into our analysis!

What’s going on with Disney stock right now?

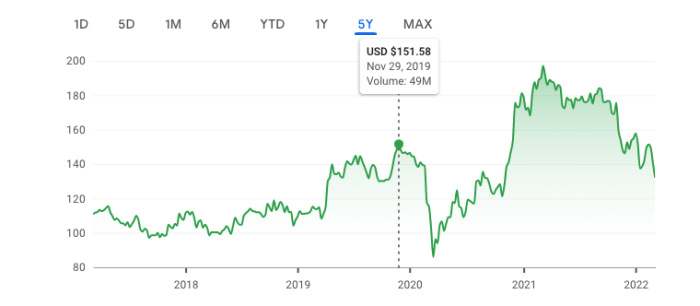

As we mentioned above, Disney stock has been on a WILD ride lately — one might say it is truly the wildest ride in the wilderness (just look at the graph below!). According to stock information from Google, back in November of 2019, Disney reached a high of $151.58 in terms of a price per share. That was a pretty high value at the time. But, things took a turn just a few months later when COVID-19 was identified in the U.S.

The COVID-19 pandemic impacted businesses across the globe, including Disney. No aspect of the company was left untouched — the parks closed for months and there were no movies being shown on the big screen for a while — and all of that led to some huge impacts on the stock. After the pandemic started, Disney’s stock took a MASSIVE hit and went to a low of $85.98 in March of 2020.

But, that low didn’t last forever. Just as things changed with the pandemic, things changed with Disney’s stock and it gradually started to rise back up again. Disney stock then made some HUGE leaps and surged well past previous top levels.

In fact, just a year later, in March of 2021, Disney’s stock hit the highest level seen over the past 5 years of $197.16. Talk about just how big of a difference a year can make. By March of 2021, things at the Disney company were massively different. Most parks had reopened across the world or were getting ready to reopen, more hit shows and movies had landed on Disney+, Disney+ subscribers were on the rise, and other parts of the company showed great promise.

Since then though, things have declined a bit. On January 21st, 2022 the stock was at $137.38. The earnings call for Q1 of FY 2022 was then held on February 9th which led the stock values to increase up to around $151. Why the bump up? Well, the earnings call/report showed better than expected growth in Disney+ subscribers, record earnings for the parks, and more “good news” for investors.

But, now things are on the decline again. As of March 8th, 2022, the stock is priced at around $132. That’s not as bad as the low hit in 2020 for sure, but not nearly as high as things were back in March of 2021.

Of course, things could all change soon.

So, that’s a view of the stock right now, but where could it be heading in the future?

What could the future look like?

Good things (where the stock could gain value)

There are some reasons why the stock could go up (significantly) within the next few months/years.

For example, Disney+ could bump up the stock value IF it does well. If Disney can continue to surpass expected Disney+ subscriber increases and show more progress in hitting its overall goal of 230-260 million Disney+ subscribers by the end of Fiscal Year 2024, then we could see a big jump in stock value. But, a slowdown in the number of subscribers (which has been the case recently) could cause concern and impact stock values negatively.

Other general success with Disney+ could also boost stock value as many investors (and The Walt Disney Company) seem to be placing heavy emphasis on Disney+ at the moment. Based on the transcript shared by Motley Fool for Disney’s latest earnings call (Q1 Fiscal Year 2022), Disney+ was mentioned about 41 times. So yeah, it’s a BIG deal.

Straight to Disney+ series/movies like The Mandalorian‘s 3rd season, more Marvel series coming to Disney+, new Star Wars series coming to Disney+ (like the Obi-Wan Kenobi series), and movies like Hocus Pocus 2 and Turning Red could bring in more subscribers, more money for Disney overall, more guest spending on merchandise related to those stories, etc. And all of that could lead to increases in the price/value of the stock.

Additionally, Disney recently announced that they will be introducing a new ad-supported subscription option for Disney+ in 2022. So, we could see those Disney+ subscription numbers grow even more soon.

Beyond Disney+, continued financial success in the Disney Parks could also be a big boost to stock. We’ve seen the parks division hit some RECORD numbers recently and, if they are able to keep that up, investors could be very pleased!

Disney has a number of parks and experiences projects that should be completed within the next few years (like the TRON Coaster and Guardians of the Galaxy Coaster in Disney World, expansions or reimaginings at Tokyo Disneyland and Disneyland in California, the EPCOT transformation, and Disney Cruise Line’s new ship — The Wish). If these do well, are popular with fans, and encourage more guests to come to the parks (and thereby spend their money in the parks) they could all prove to be big wins for the parks division and cause the stock to go WAY up.

Plus, that’s not even taking into account what could be announced at the upcoming D23 Expo and beyond!

Even with these projects still in the works, spending at the parks is still up due in part to increases in prices and also things like Disney Genie+. In fact, we saw HUNDREDS of price increases impact food items in the parks in early 2022 and certain ticket prices have also increased in 2022 as well. If this trend of price increases continues and guests continue to spend more in general and buy “bonus” items like Genie+ in the parks, that could also improve stock value.

Yes you ARE spending more in the Disney parks — click here to see WHY!

There’s also the cinema component to consider. Whether films find their success on Disney+, in theaters, or both, success in the movies can equal success with the stock. Recent movies like Spider-Man: No Way Home and Encanto took off BIG TIME and big hits like these can lead to more money when it comes to merchandise, cinema awards and nominations, and more.

And, there are more highly-anticipated films on their way soon including Lightyear, Doctor Strange and the Multiverse of Madness, Thor Love and Thunder, and Black Panther Wakanda Forever. If successful, these movies and others (like the upcoming Avatar films) could show investors that the stock is worth buying and, in turn, push prices up.

And some analysts are already predicting that Disney stock will indeed perform better in the future. According to Market Watch, back in early February, some had identified Disney’s stock as “overweight.” In the stock world, an “overweight” rating usually means that analysts believe that the “stock price should perform better in the future.” (Definition obtained from Investopedia).

Click here to see 5 BIG Disney World changes for 2022

Concerns (ways that the stock could be impacted negatively)

But it’s not all flowers and sunshine — some storm clouds could also be on the horizon and cause the Disney stock price to go down over the next few months.

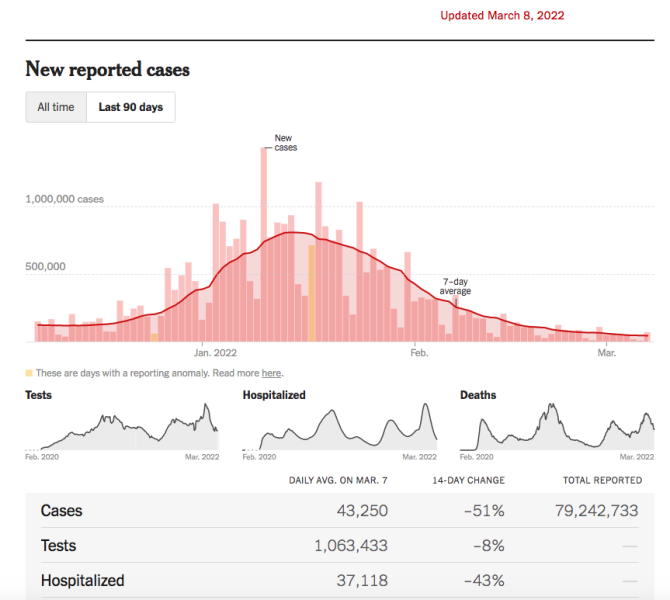

For example, a resurgence of COVID-19 cases, a new variant, or any other pandemic-like situation could cause major impacts. Right now, cases of COVID-19 appear to be on the decline as shown by the case numbers reported by the New York Times. We’ve seen a substantial change in COVID-19 cases compared to where the U.S. was just months ago, but some experts caution that there is still a ways to go before things are back to “normal.”

With the decline in cases, mask rules have changed in the Disney parks, on Disney Cruise Line, and elsewhere in accordance with the Centers for Disease Control and Prevention’s new mask guidelines. But, if cases of COVID-19 go up again significantly, a new variant is discovered, or a new pandemic-like situation begins to impact the world, we could see March 2020 repeat itself when it comes to Disney stock.

Even today, some of Disney’s businesses are still being affected by COVID-19, as Hong Kong Disneyland remains closed and has extended its closure through April 20th. If Disney finds the need to close down more parks, shut down its cruises, put in more mask mandates, bring back social distancing and more strictly limit capacity, etc. that could severely impact the parks business and would undoubtedly impact stock value.

Inflation is another thing that could impact Disney’s stock value. It’s already on the minds of some analysts (and some Disney executives) and could prove to be a big factor in stock prices going forward (not to mention increased costs in the parks). CNBC reports that Atlantic Equities previously indicated that “additional cost pressures were notable and ‘inflation is perhaps the most concerning,'” when it comes to Disney’s parks.”

JP Morgan had also noted potential impacts of inflation but had more confidence for Disney moving forward. According to JP Morgan, “While there are increased costs associated with new attractions and inflationary pressures near term, we are confident that the parks can emerge from the pandemic with better profitability given the improvements the company has been able to implement, along with innovations such as Genie+.” Disney did hit those record numbers for the parks department during Q1 of Fiscal Year 2022, so that might have calmed some fears. But, concerns in general about inflation are far from over.

Delays in parks projects and negative feedback about parks projects could also impact parks profit or overall feelings about the parks, and potentially stock value. There have already been a number of delays on projects like the TRON coaster, the Disney Wish cruise ship, and more. Plus, there have also been several projects that have disappeared or been indefinitely postponed — like the Spaceship Earth renovations, the Mary Poppins attraction, and the Quinjet attraction in Disney California Adventure.

Some recent projects have also received negative/mixed feedback — like Harmonious at EPCOT and specifically the less than pleasant view that the barges create during the day. The Star Wars Hotel (Star Wars: Galactic Starcruiser) also received a heavy amount of criticism prior to its official opening, partially due to its high price. But, some of that negative feeling toward the experience may have shifted now, however, as guests have been able to stay at the Star Wars Hotel for the first time.

If Disney projects get further delayed or receive more negative feedback, it could impact the view of the parks department and potentially Disney’s stock.

Outside of the parks, discontent with Disney’s current CEO could also impact stock values. Whether or not you agree, there has been some criticism of Bob Chapek in certain communities. The New York Post recently revealed that some Disney shareholders were exploring whether they could get Chapek voted out though some experts have noted that, realistically, the shareholders can’t vote Chapek out as CEO.

Now, criticism of a company’s leadership isn’t unusual or unexpected, but the loss of Bob Iger as an executive in the Company is something that might be causing certain individuals to be concerned right now. According to Variety, one media figure shared that Iger’s “walking off is going to be such a loss for us all.” Iger was seen as a big figurehead and was praised for his work in acquiring other companies like Marvel and Lucasfilm. Iger officially stepped away at the end of 2021 after years leading the Disney Company.

Chapek has also been handling some criticism lately due to Florida’s “Don’t Say Gay” Bill which could influence some investors decisions as well.

And, lastly, supply chain issues, staffing concerns, and a number of other factors could also impact Disney stock.

Should you buy now?

So, taking all of that into consideration — should you buy Disney stock right now? Well, it depends!

Some say yes

Some feel like now IS the time to buy stock in Disney. According to details shared on the Nasdaq website, Disney is identified as a “strong buy” based on the recommendations of 23 analysts over the last 3 months. What exactly does that mean though? Investopedia notes that a “strong buy” is a “recommendation given by analysts for a stock that is expected to dramatically outperform the average market return and/or the return of comparable stocks in the same sector or industry.” Basically, it’s an “emphatic endorsement” of the stock and a recommendation to buy the stock.

This is backed up by other reports with the Wall Street Journal noting that the consensus appears to be that Disney’s stock is overweight (meaning that analysts believe that the “stock price should perform better in the future”) and MarketBeat reporting that Disney “received an average rating of ‘Buy’ from the twenty-six brokerages that are currently covering the firm.” That’s a pretty strong showing of support for the stock.

Others say no

But others have concerns. As Yahoo reports, Guggenheim did downgrade Disney’s stock from “buy” to “neutral” back in January of 2022 (granted, that was before the last earnings call), and there were also some downgrades back in late 2021.

While these downgrades aren’t as bad as they could be, some feel that Disney’s stock needs to show some improvement before recommending that people buy it. For example, in early February of 2022, Investor’s Business Daily said that the Disney is “worth watching…to see how the media giant fares now that its theme parks, cruises and movie theaters are back in action.” They specifically identified that the Omicron COVID-19 variant would be a big factor going forward and shared their feeling that individuals should “wait until the market is in a confirmed uptrend, which means investors can buy leading stocks at proper buy points.”

Seeking Alpha also shared a post back in early February 2022, based on a trading alert from Wheel of Fortune, regarding thoughts on Disney stock. According to that post, Disney’s stock has been “delivering way less impressive results over the past two years” and “underperforming both its benchmarks as well as its main competitors.”

In that article, they also share that they expect that Disney’s “underperformance” will likely continue for another year and that “investors should still keep their expectations from DIS down to (COVID) earth.”

Seeking Alpha rated the Disney stock as “hold” (meaning that they recommend neither selling nor buying at this time), noting that they “have tremendous respect for the Disney brand, and [] believe that at some point, though not in 2022, the company may regain its (post-COVID) mojo.”

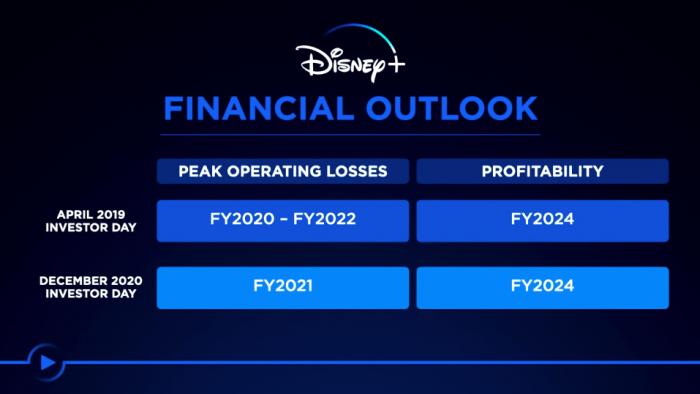

Another analyst who spoke with CNBC is also somewhat skeptical of Disney’s stock value. Cowen analyst Doug Creutz shared that the parks results were “pretty remarkable,” but he shared that Disney’s media business as a whole is what keeps him skeptical. He shared that while the subscriber numbers for Disney’s streaming platforms are impressive, they’re still losing millions of dollars. Disney has previously said they project that they will break-even in 2024 (when it comes to the streaming side), but that still only means moderate profitability.

So…should you buy Disney stock now? That depends. There are reasons why you might want to, and other reasons why you might not want to buy it at this moment — it all depends on your thoughts and reactions to these analysts’ recommendations and the potential factors that could impact stock in the future.

Of course, we’ll continue to keep an eye out for more updates about Disney’s stock and we’ll let you know what we see! And, in the meantime, be sure to stay tuned to DFB for more of the latest Disney news and updates!

Are Disney parks back at full capacity yet? An executive answers HERE!

Join the DFB Newsletter to get all the breaking news right in your inbox! Click here to Subscribe!

Don't Miss Out on Any Disney Fun!

Order Your Copy of the 2022 DFB Guide to Walt Disney World Dining Today!

With more than 750 pages, the 2022 DFB Guide to Walt Disney World Dining is full of tips and planning tools developed by Disney World experts over 30+ years of visits. We've done the research for you, so you'll know just which spots will uniquely suit your family's needs!

With more than 750 pages, the 2022 DFB Guide to Walt Disney World Dining is full of tips and planning tools developed by Disney World experts over 30+ years of visits. We've done the research for you, so you'll know just which spots will uniquely suit your family's needs!With mini-reviews of every single restaurant, bar, lounge, kiosk and more; an entire chapter on the best snacks in Disney World; full Disney Dining Plan analysis (and how to get FREE dining); and a full chapter on discounts and deals; you'll have everything you need to plan your best vacation yet.

Click here to order your copy of the 2022 DFB Guide to Walt Disney World Dining E-book with code WDW2022 to save 25% off the cover price today!

Use code WDW2022 at check-out for 25% off the cover price today!

Our guides are backed by a 100% money-back guarantee, so you have nothing to lose.

Do you own Disney stock or are you thinking about buying some? Tell us in the comments!

The post What's the Future of Disney Stock and Should You Buy Now? first appeared on the disney food blog.

from the disney food blog https://ift.tt/uO2NWjM

Post a Comment